Introduction

CFOs and Finance teams today are facing increased pressure and expectations to produce accurate and insightful reporting at speed. Why? To enable all aspects of financial management reporting and analysis required for the board of directors, equity stakeholders and functional leaders. Those requirements are especially true with Narrative Reporting and the Office of Finance.

As C-suite leaders with a bird’s eye view of corporate performance, CFOs have a strategic imperative to provide trusted insights across all aspects of the business. CFOs must also do that while driving automation, maximizing productivity and reducing risk.

A key element to that ability is being able to tell a narrative or the story behind the numbers. However, this responsibility does not fall solely on CFOs and Finance teams. That’s true even though both are the stewards of delivering trusted results for quarterly financial, budget variance and board packages with rich narratives of performance. Rather, the narrative process involves collaboration across all business leaders. Such collaboration requires not only comparing the latest results to plans and targets, but also describing both the good and the bad in context. In fact, those aspects are essential to telling the story of the latest results to the board of directors, equity stakeholders and functional leaders.

Moving Beyond the Numbers

At a recent OneStream event, moving beyond the numbers to telling the story behind the numbers, was the message from several of our customers and prospects. One Finance leader put it this way: The whole Finance profession has, for too long, focused primarily on just the numbers. While the numbers need to be accurate and trusted, the ability to look beyond just the numbers and into the why is becoming increasingly more important. How do we explain our performance and tell the story behind the numbers?

Finance is uniquely positioned to not only deliver trusted results but also facilitate the storytelling process to put numbers in context with current and future business performance. This process is Narrative Reporting, and it is a combination of people, process AND technology. So how do we unify and streamline this process in technology to help facilitate corporate storytelling?

The Narrative Reporting Challenge

Narrative Reporting is traditionally a time-consuming, complex and inefficient manual process. To tell the story behind the numbers, Finance must collect comments, assemble data and reports, and create narratives for reporting.

Yet current solutions and approaches for Narrative Reporting comprise the following:

- Multiple tools

- Duplication of data and metadata

- Cut-and-paste reports, data and comments

- Manual creation of narratives in documents, spreadsheets or separate solutions

This mix creates complexity in the assembly, review and approval of narratives and narrative reports. As a result, the process involves difficulties. How? Incorporating the collaboration needed across the business for the analysis and collecting insights from business leaders to pull together the story both become more difficult.

Ultimately, traditional approaches fall outside your CPM system (arguably your system of record for performance). Thus, Finance teams are challenged to execute the process to collect the narratives and facilitate the needed analysis. Those challenges introduce the risk of reporting errors, resulting in lack of trust in the reports, data and narratives used for financial and management reporting.

OneStream’s New Approach to Narrative Reporting

To address the challenge, OneStream is introducing a new approach to Narrative Reporting at our Connect London event on April 24, 2024. The new approach streamlines and centralizes Narrative Reporting. How? By uniquely unifying it with all consolidation, close, financial and operational planning to automate the narrative assembly, live analysis, review and reporting processes.

The approach ultimately eliminates reliance on the old approach. That means Finance no longer needs multiple solutions and tools. Nor is copying and moving data and metadata, rekeying and cutting/pasting necessary. Thus, the new approach simplifies the process and ensures context, confidence and auditability within the Narrative Reporting process.

Key Features

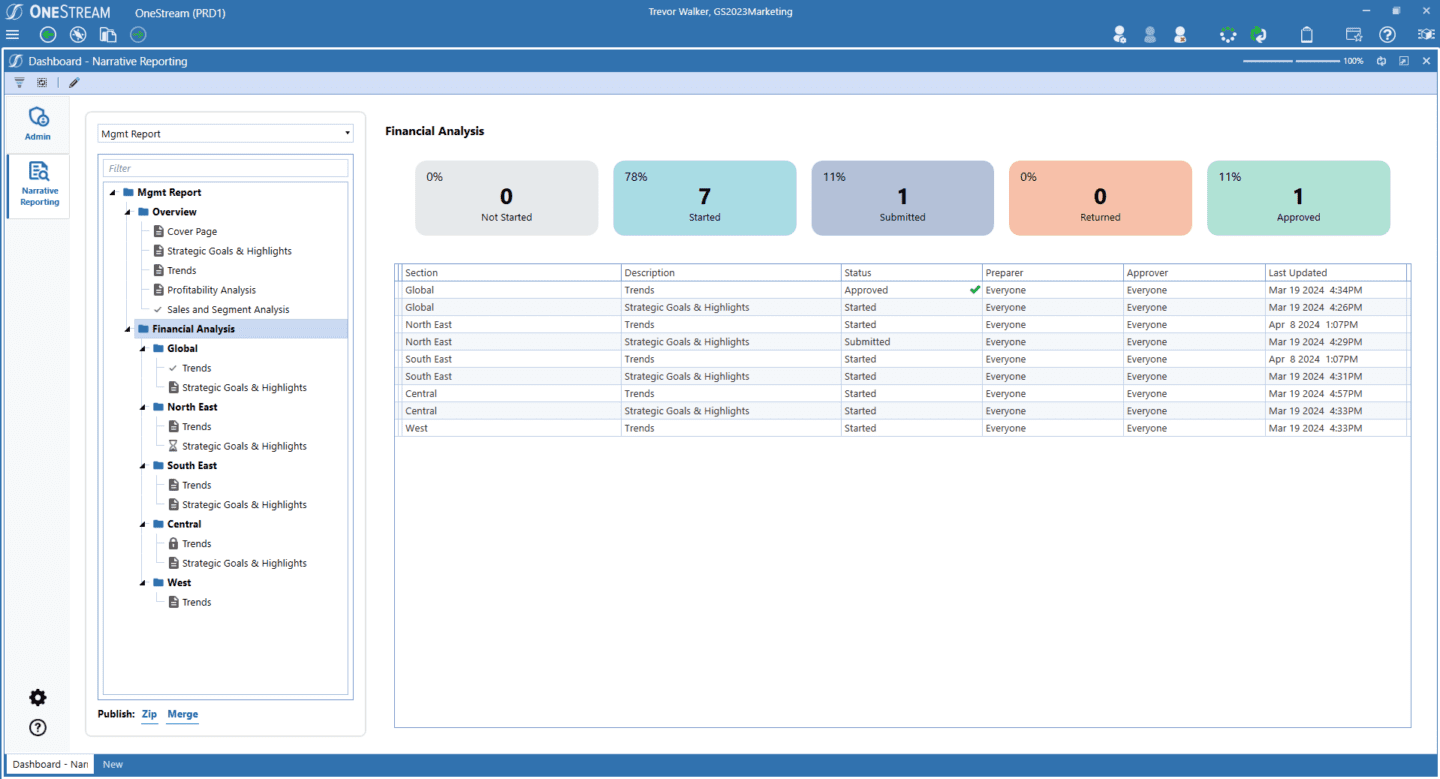

The new approach uniquely unifies and streamlines narrative report creation, from narrative assembly to data analysis and narrative capture. As a result, Finance leaders can leverage live OneStream data to drive transparency, confidence and contextualization behind financial data. Key features of OneStream’s new approach to Narrative Reporting include the following:

Centralize Everything

Centralize the creation of Narrative Books all in one place in OneStream, organizing all report content, live analysis and collaborative capture of narratives. Centralization ensures Finance and business leaders can analyze and communicate the story behind the corporate performance.

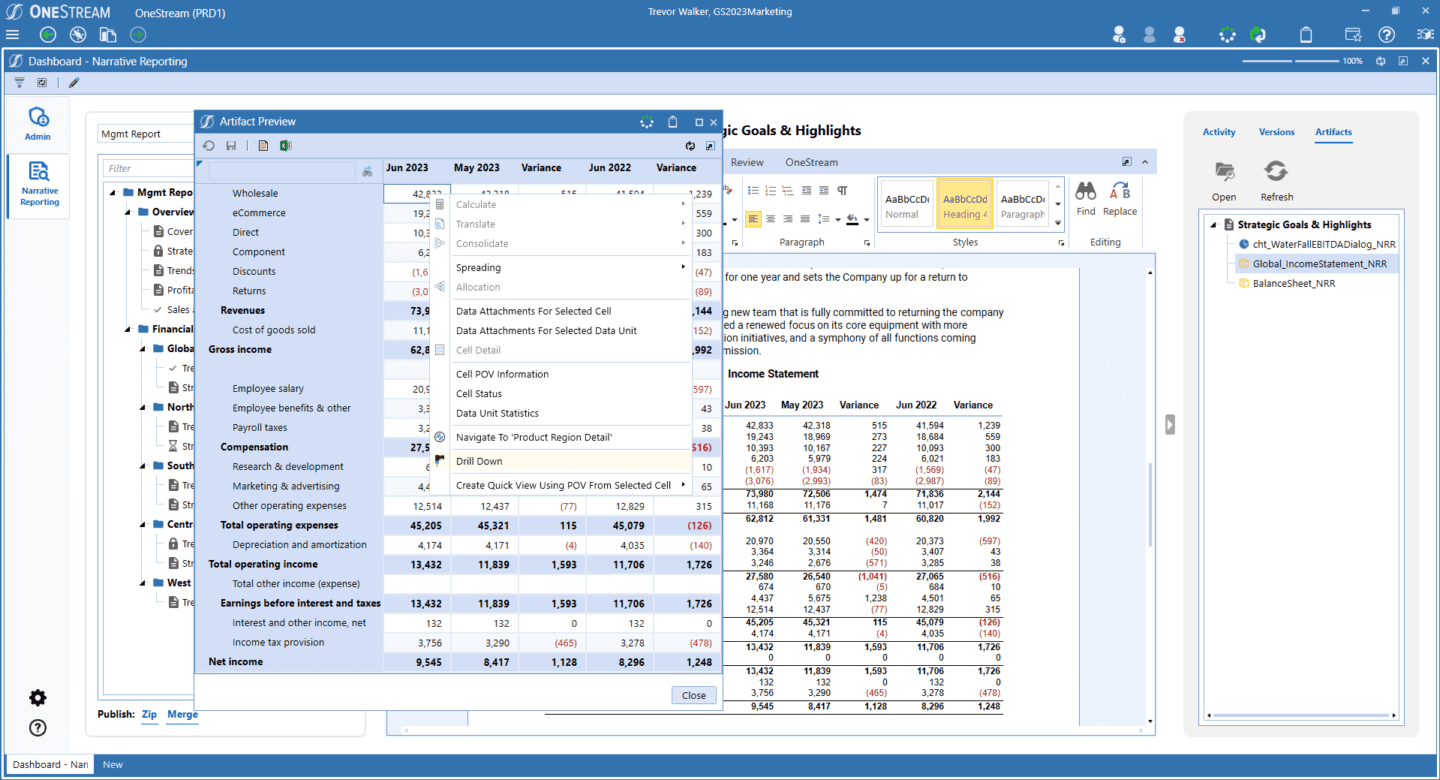

Live Analysis at Every Step

Contextually analyze live, validated OneStream data and report content rather than relying on static or copied data in many different solutions and tools. Live analysis streamlines the analysis, review and narrative capture process.

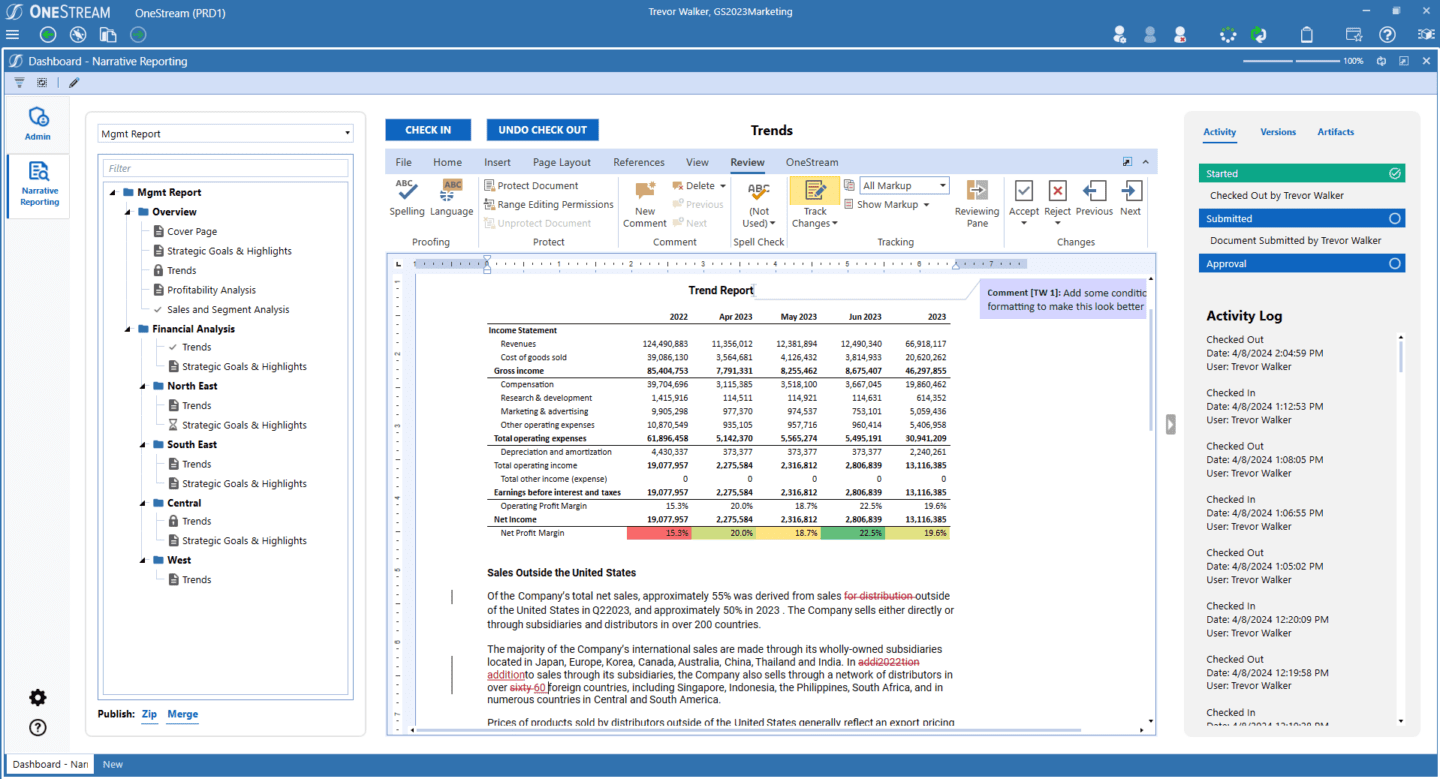

Collaborate and Approve with Confidence

Collaborate with comments, track changes, views of all activity, submission/approval processes and version management to reduce risk and reporting errors.

Automate Narrative Reporting Processes

Embed Narrative Reporting in the close, planning and other workflow processes with approvals to collect narratives during consolidation, close, and financial and operational planning process. This saves time, drives efficiency and collaboration, and ensures confidence in the Narrative Reporting process.

Leverage a Trusted and Familiar Interface

Leverage the same OneStream interface and trusted reporting content alongside the familiarity of Microsoft Office to capture narratives and create rich, formatted and collaborative Narrative Books. Intuitively combine rich text documents, text, Word documents, Excel sheets and PDF documents, all uniquely unified in one solution. Finance can thus easily capture narrative content and deliver formatted Narrative Books.

One of our OneStream public sector agencies previously used six different tools to build its 1,400-page budget to submit for annual budget appropriation. The agency now only uses OneStream to create all its budget books, including budget briefs, justifications and final budgets. With OneStream, the agency achieved the following:

- Streamline the budget and narrative process

- Standardize and automate the process with master templates and exhibits

- Shorten the budget change and narrative capture process from days to minutes

OneStream Narrative Reporting Availability

OneStream’s new approach to Narrative Reporting is available today and will be officially launched at our Connect London event on April 24th and highlighted at our annual Splash User Conference in Las Vegas on May 20th. Other new innovative capabilities and Solution Exchange solutions will also be unveiled.

We encourage our customers, prospects and partners to attend these events, visit our Website and check out our social media posts for more details on this new approach to Narrative Reporting.

Conclusion

Over 1,400 companies globally have made the move to OneStream’s Intelligent Finance Platform. Why? To unify consolidation, close, financial and operational planning, reporting, and analysis, to deliver confidence and trust in the results. And to move beyond the numbers to tell the story of corporate performance.

To better understand why, visit our website at www.onestream.com.

Learn MoreGet Started With a Personal Demo