Scenario planning is a valuable tool for businesses looking to prepare for the unexpected, but creating accurate scenarios can be a complex and time-consuming process. Traditionally, these exercises required substantial iterative cycles and were very manual.

That’s where artificial intelligence (AI) and machine learning (ML) forecasting come in – these technologies can help businesses power their scenario plans with more accurate and reliable data, allowing them to make better-informed decisions and stay ahead of the curve.

Powering Scenario Plans with AI & ML Forecasts

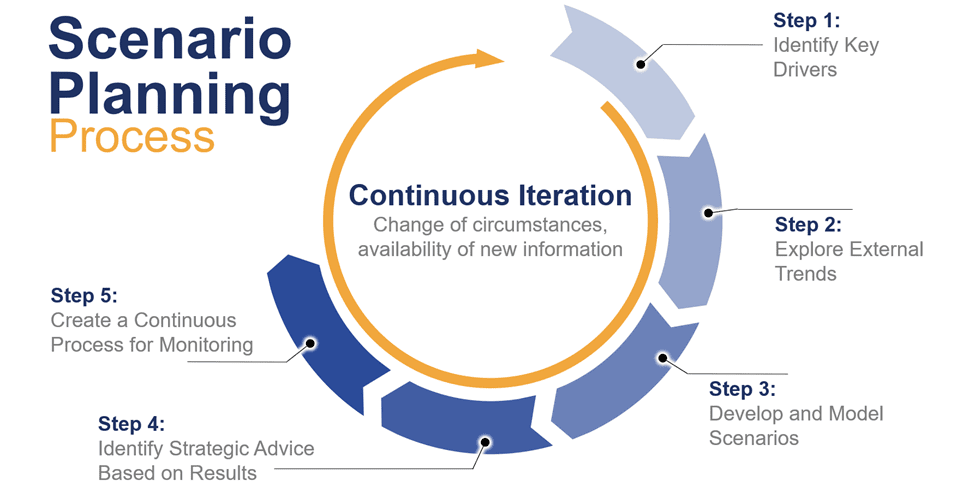

Scenario planning involves creating multiple possible futures for a business, considering a range of different variables such as market trends, consumer behavior, and technological advancements. The process typically involves identifying key drivers of change, developing a range of plausible future scenarios, and assessing the potential impact of each scenario on the organization.

The goal is to identify potential risks and opportunities and prepare accordingly rather than simply reacting to events as they happen. Scenario planning can help organizations make more informed decisions by enabling them to anticipate potential future events and develop strategies to mitigate risks and take advantage of opportunities. (see figure 1)

Scenario planning involves creating multiple possible futures for a business, considering a range of different variables such as market trends, consumer behavior, and technological advancements. The process typically involves identifying key drivers of change, developing a range of plausible future scenarios, and assessing the potential impact of each scenario on the organization.

While scenario planning can be a powerful tool, creating accurate scenarios can be a challenge. Traditional scenario planning methods can be time-consuming and challenging to execute. One of the main challenges is forecasting. Forecasting involves predicting future events, such as changes in consumer behavior, market trends, and technological advancements.

Traditional forecasting methods often rely on historical data and expert opinions, which can be unreliable and may not reflect current market conditions or emerging trends. Additionally, traditional forecasting methods may not account for the complex interrelationships between different factors that can influence future events. It’s difficult to predict exactly how different variables will interact, and human biases can creep in, leading to scenarios that are overly optimistic or pessimistic.

That’s where AI and ML forecasting comes in.

The Role of AI and ML in Scenario Planning

Advances in AI and ML have made it possible to enhance scenario planning by providing more accurate and reliable forecasts. AI and ML can analyze vast amounts of data and identify complex patterns and relationships between different factors. This can enable organizations to develop more sophisticated and accurate forecasts that reflect current market conditions and emerging trends.

By incorporating AI and ML forecasting into scenario planning, businesses can create more realistic and useful scenarios, helping them to make better-informed decisions and stay ahead of the curve.

Data analysis

AI and ML can help organizations analyze large amounts of data and identify patterns and trends that are not visible to humans. This can provide insights into potential future scenarios and help organizations prepare for them.

Use Case: Enrich Data to Identify Patterns

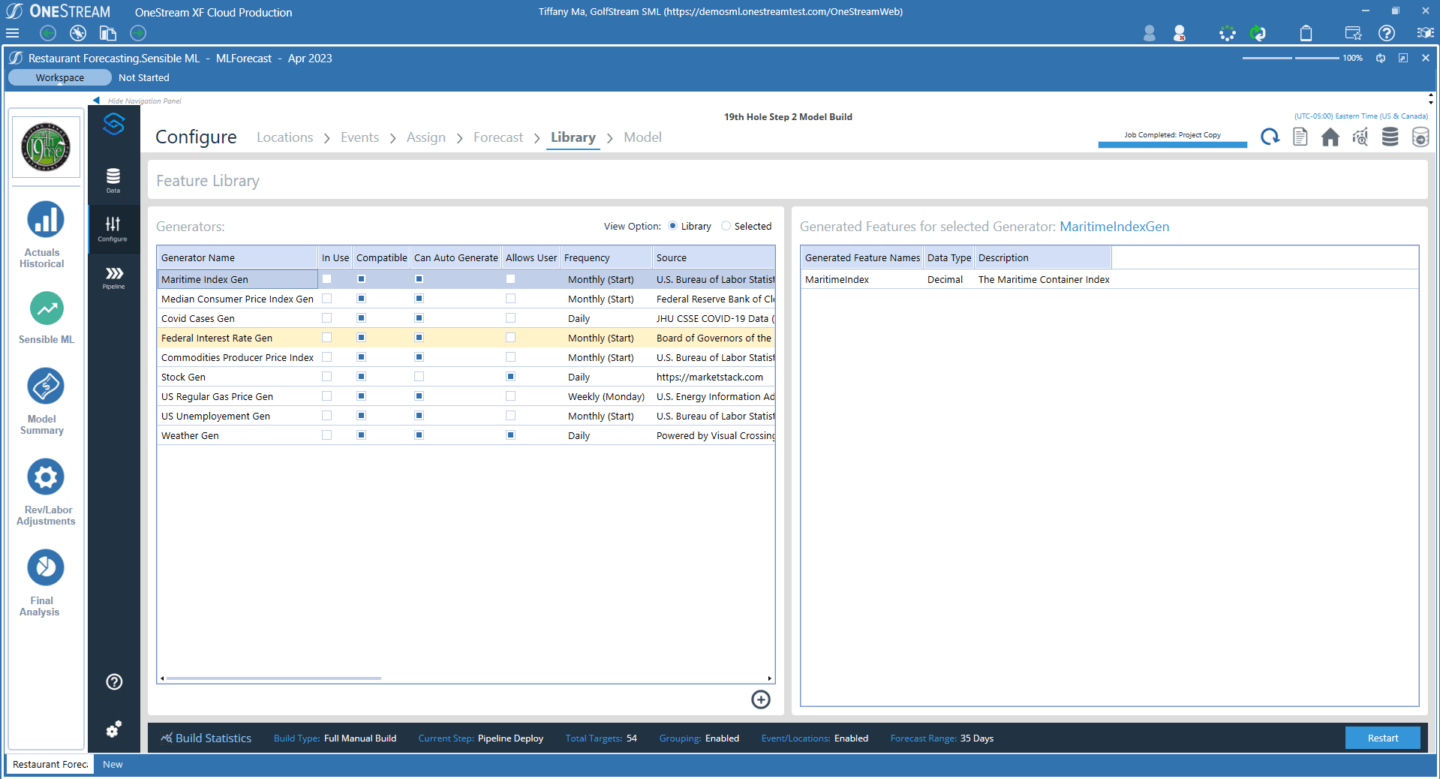

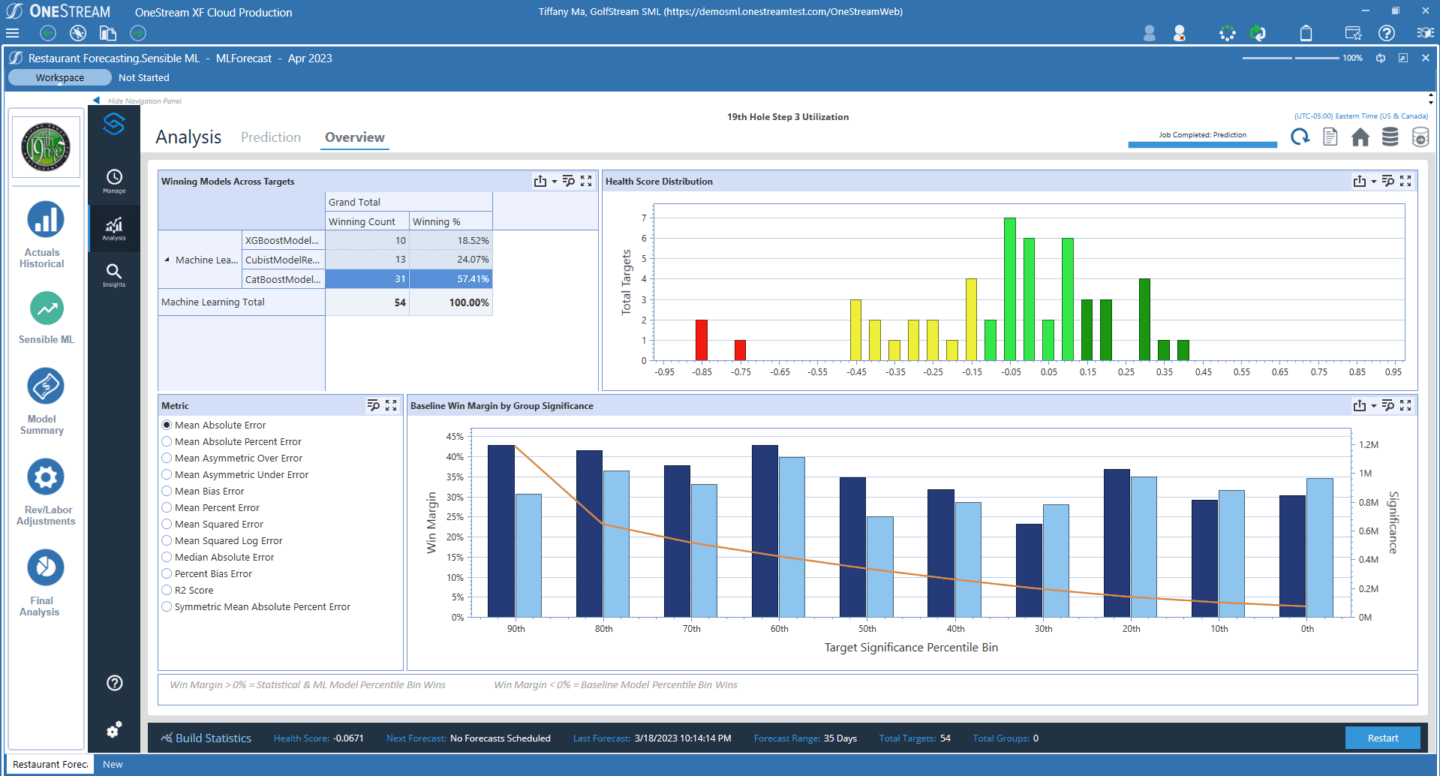

AI and ML can be used in scenario planning by incorporating external data sources, such as social media, news articles, and weather forecasts to help understand to what extent these factors correlate with forecast performance. By analyzing these sources in real time, organizations can identify emerging trends and adjust their scenarios accordingly. (see figure 2)

For example, a manufacturer might use AI to analyze social media conversations about its products and identify emerging customer preferences. By incorporating this information into its scenarios, the manufacturer can adapt its product development and marketing strategies to meet customer needs better.

Prediction

AI and ML can be used to predict future outcomes based on historical data. This can help organizations identify potential future scenarios and make informed decisions about how to respond to them.

Use Case: Predicting Consumer Behavior

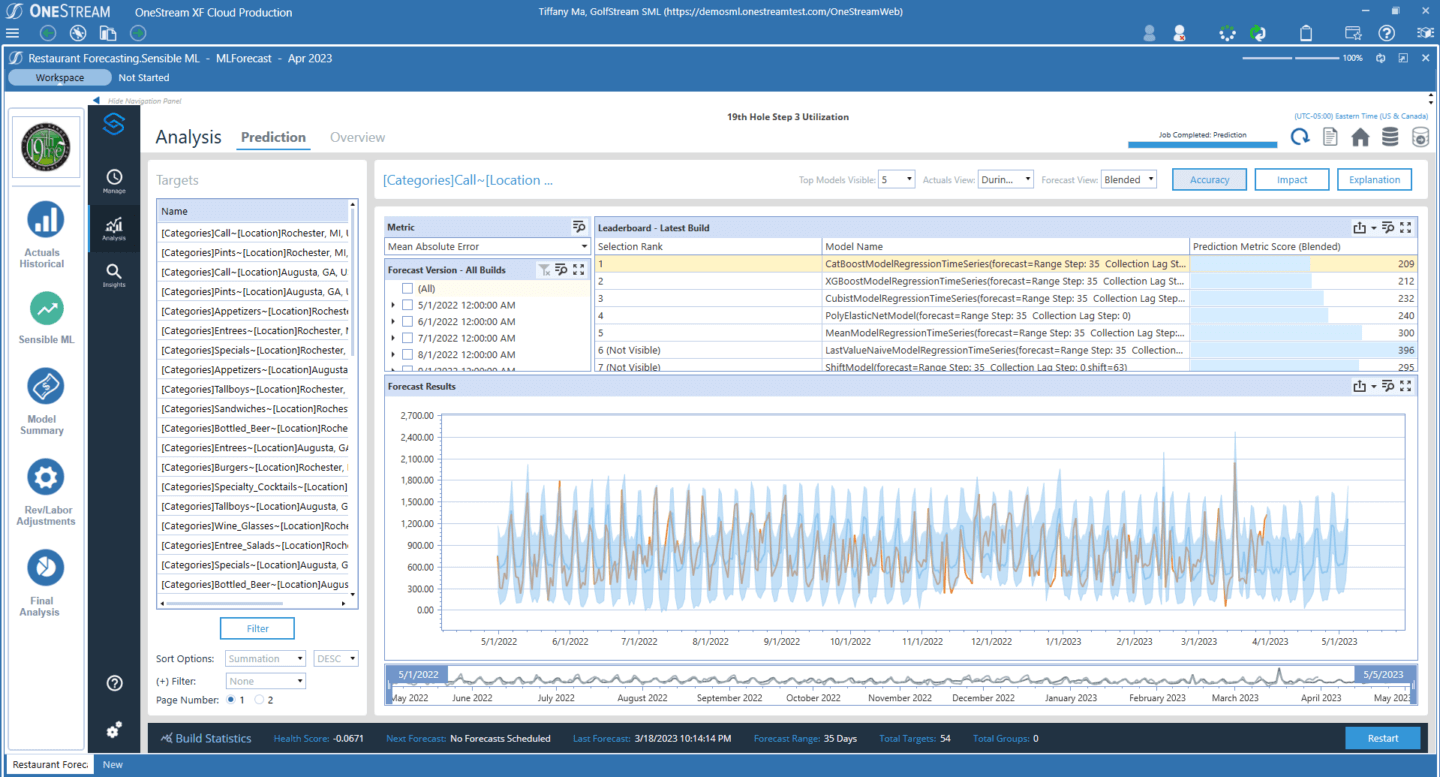

One key variable in many scenarios is consumer behavior. Businesses need to understand how consumers will respond to new products, changes in pricing, and other factors in order to make informed decisions. AI and ML forecasting can be used to analyze consumer data and predict how consumers will behave in the future. This information can be used to create more accurate scenarios and identify potential risks and opportunities. (see figure 3)

For example, consider a retail company that is considering launching a new product. By using AI and ML forecasting to analyze consumer data, the company can predict how many units of the product it’s likely to sell in different scenarios. This information can be used to create different sales forecasts for different scenarios, allowing the company to prepare accordingly.

Simulation

AI and ML can be used to create simulations of potential future scenarios. This can help organizations understand the potential impact of different decisions and prepare for them accordingly. (see Figure 2)

Use Case: Forecasting market trends

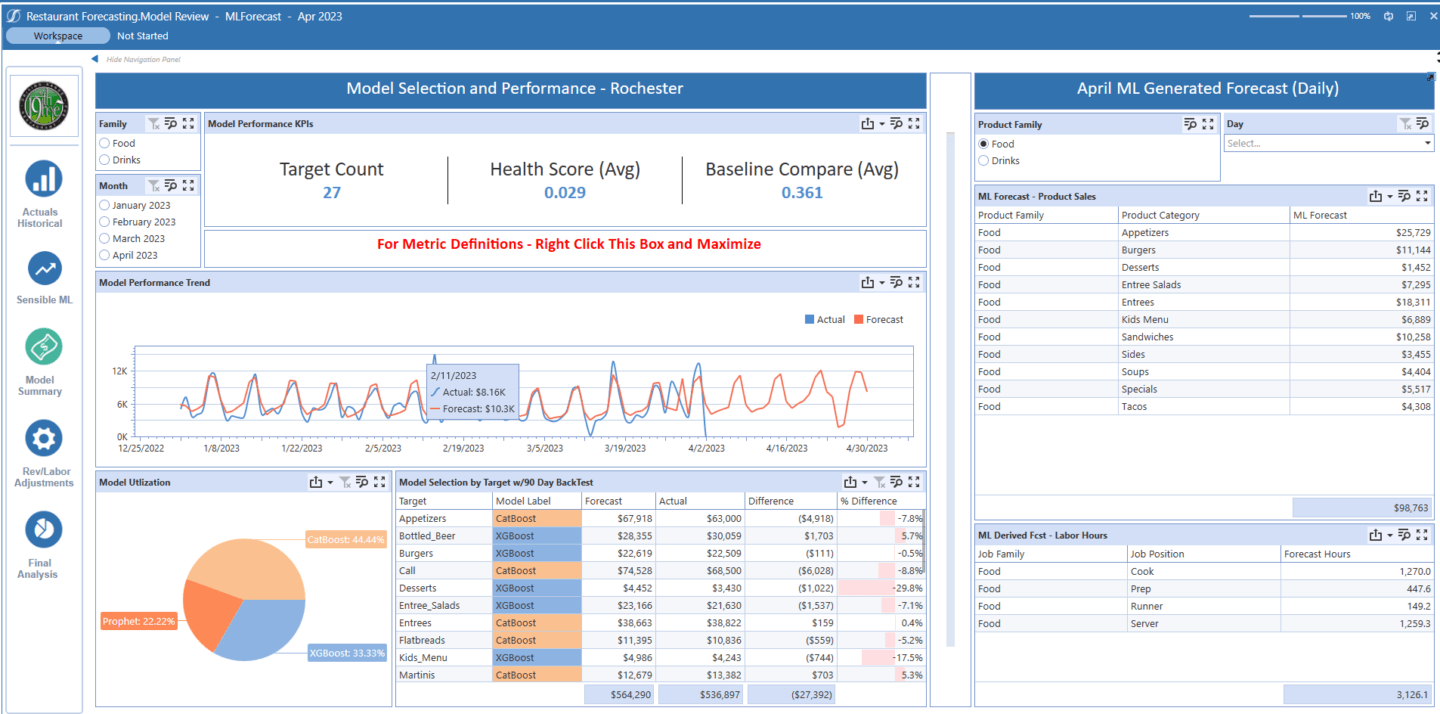

Market trends are another important variable in scenario planning. Businesses need to understand how the market is likely to change in the future in order to make informed decisions. (see figure 4)

For example, consider a financial services company that is creating scenarios for the next five years. By using AI and ML forecasting to analyze market data, the company can predict how interest rates, inflation, and other key variables are likely to change over that time period. This information can be used to create different economic scenarios, allowing the company to prepare accordingly.

Optimization

AI and ML can be used to optimize scenarios by identifying the most likely outcomes and helping organizations prepare for them. This can help organizations be more effective in their scenario-planning efforts.

Use Case: Predicting Supply Chain Disruptions

Supply chain disruptions can have a significant impact on businesses, especially those that rely on just-in-time inventory or complex global supply chains. AI and ML forecasting can be used to analyze supply chain data and predict where disruptions are most likely to occur. (see figure 5)

For example, imagine a manufacturing company is creating scenarios for the next year. By using AI and ML forecasting to analyze supply chain data, the company can predict where disruptions are most likely to occur – for example, due to natural disasters or political unrest. This information can be used to create different scenarios for supply chain disruptions, allowing the company to prepare accordingly.

In each of these examples, AI and ML forecasting allows businesses to create more accurate and realistic scenarios, helping them to make better-informed decisions and stay ahead of the curve.

Conclusion

AI and ML technologies have been a catalyst for organizations to relook at how they leverage scenario plans, the pace at which they plan decisions, and the data they use to make those decisions. Customers can overcome the tedious and time-consuming scenario planning by enriching the process with AI and ML solutions by providing faster, more accurate and reliable forecasts.

Learn More

To learn more about how FP&A teams are moving beyond the AI hype to enrich scenario planning, check out our white paper, Sensible Machine Learning for CPM – Future Finance at Your Fingertips.

In today’s fast-changing business and economic environment, managers can no longer wait until month-end or quarter-end to receive critical financial and operational metrics they need for decision-making. We are hearing more and more demand from finance executives and line managers for daily and weekly metrics they can use to identify key financial signals and trends in their businesses that enable agile decision-making.

As a case in point, I recently had a chance to interview Lynn Calhoun, Chief Financial Officer at BDO, a global accounting, tax and advisory firm. Read on to hear how BDO is delivering daily operational insights and financial signals to over 5,000 managers across the organization, as well as supporting their traditional financial close, consolidation, reporting and planning processes – all through OneStream’s unified, Intelligent Finance Platform.

Keeping Up with Growth and Increasing Complexity

BDO USA is part of an international consortium of accounting, tax and advisory firms that operates in 167 countries worldwide. BDO USA is the US arm of that global network and has been experiencing very significant growth over the course of the past ten years. This occurred both through organic growth as well as M&A activity.

BDO had been using Oracle Hyperion for several years for financial reporting and planning and according to Mr. Calhoun, “It just wasn’t keeping up with our growth and the complexity of our business as it was continuing to evolve. And primarily in the operational area where we were trying to provide a lot of customer analytics to our user community.”

To address their needs, BDO had created 13 different Essbase cubes, which weren’t very integrated and required the users to go to different places to get the information they needed. So they began talking to OneStream, and several of our customers, and became convinced that OneStream could handle the growing volume at the time, and what they expected in the future.

Moving to Right Time Finance

For their OneStream implementation, BDO used the “big bang” approach, implementing the platform for planning, reporting and analytics all at the same time. In fact, the global pandemic of 2020 forced them to launch their new planning application a little earlier than planned. But what’s really powerful is how BDO went beyond the traditional monthly reporting and planning process with their OneStream solution.

BDO was one of the first customers to leverage OneStream’s Analytic Blend capabilities to integrate detailed transactional data with their summarized financial data to empower managers with critical insights on a daily and weekly basis. This includes critical data about their clients, projects, resources, billings, DSO and other metrics that help them guide the business.

According to Mr. Calhoun, “On the operational side, we’re pulling a lot of data into OneStream. On a nightly basis will pull in our entire data set again and refresh that on a nightly basis. So anybody at any point in time can pull up data related to the projects that are running, the customers they’re responsible for, and see up-to-date information through yesterday and the performance of those projects and know that that’s something that has been a game changer for us.“

Having this daily information in front of the teams that are responsible for managing client contracts and engagements makes a huge difference in being able to spot problems quicker and to identify and address any issues faster.

Mr. Calhoun continued, “We’ve got 5000 users on the system on any given day. On an average day, we have a little over 400 to 450 people accessing the system. So not all in there every day, but they’re in there. When they are in there, the information they are looking at is current. And so it’s not like we’re waiting for a month end or mid-month to put the information in and have everybody go in at one time. It’s really designed to be more that the information is there when your schedule permits you to take a look at it, or when you want to take a look at it. And we’re not going to try to dictate when it’s available for you to look at.”

Learn More

To learn more, watch the 5-minute video interview with Lynn Calhoun and contact OneStream if your organization is ready to make the leap from multiple legacy applications to OneStream’s unified Intelligent Finance Platform for reporting, planning, analysis and beyond.

As CFOs maneuver their organizations through the warp-speed environment of the 2020s, Finance Transformation is en vogue again. Why? Let’s face it—Finance chiefs at large, sophisticated organizations cannot afford to manage their organizations with the same technology widely used for the past 20 years. Not if the goal is to actually help teams move with the agility and pace required to drive performance through periods of volatility and disruption.

With the debate on the need and value of Finance Transformation settled, Finance teams can finally focus on taking the steps needed to lead at speed. And that journey starts with a simple objective.

To lead at speed, Finance teams must finally conquer the complexity of their dis-connected corporate performance management (CPM) tools and processes.

As we shared in the kickoff of the “Inspiring Digital Transformation with Intelligent Finance” blog series, now is the time to break the cycle. But where to begin?

A good first step, and the topic for this post in our blog series, is by defining what it takes to be an Intelligent Finance organization.

The Intelligent Finance Organization

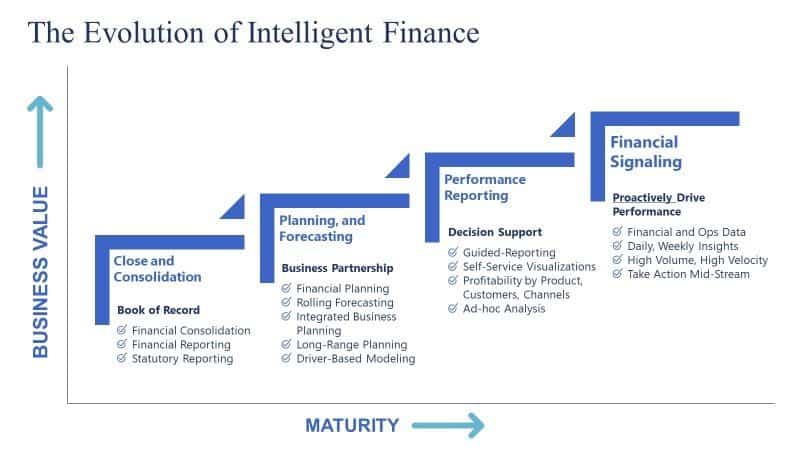

No matter where your organization sits in the transformation journey (see Figure 1), creating a collective vision, as a team, is always helpful.

Intelligent Finance offers organizations the chance to take control of their destinies. To finally leverage the benefits of technology without compromising on their requirements. To drive performance by unifying their Finance teams. By working smarter, not harder to unleash the power of Finance, empower the organization with insights to drive performance, and continuously evolve the scope and value of their Finance teams.

Here are the 3 steps to becoming an Intelligent Finance organization:

- Step 1 – Intelligent Finance teams unleash the organization from manual and disjointed processes. How? By using digital transformation to automate tedious tasks and increase the productivity and effectiveness of the financial close, planning, budgeting, forecasting and reporting processes.

- Step 2 – Intelligent Finance teams empower the organization to focus on value-driving initiatives and provide decision-makers with data-driven financial and operational insights. How? By exploring opportunities to leverage advanced analytics – such as predictive forecasting and machine learning – to elevate the accuracy and value of forecasting.

- Step 3 – Intelligent Finance teams evolve their organization and processes to address the ongoing challenges and requirements in today’s uncertain, volatile and competitive markets. How? By dedicating resources and expertise to Sales, Merchandising, Operations, Marketing and HR to accelerate decision-making and unify planning across the organization.

Step 1: Unleashing the Value of Finance through Digital Transformation

Step 1 of becoming an Intelligent Finance organization starts by unleashing your team from tedious and disjointed, manual processes. Why? Well, to start, spending time on “low-value” processes holds Finance teams back from performing higher-value work – such as evaluating new capital investments or analyzing the impact of new product innovations. Too much manual work also kills culture and adds risk to CPM processes.

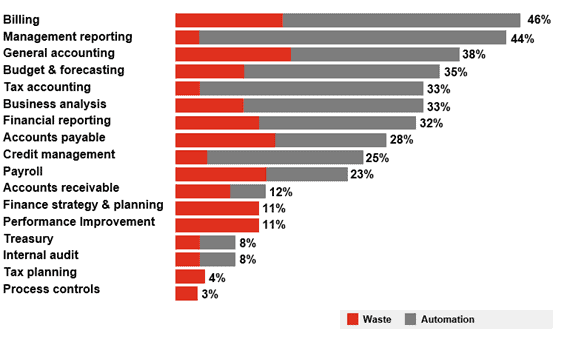

Unfortunately, according to PWC’s “Leading Finance in the Digital Era” research, manual processes are still the status quo. As PWC notes, (see Figure 2), Finance teams have a material opportunity to eliminate waste and drive automation across a number of CPM processes, including for reporting, budgeting & forecasting, and analysis.

Here are a few additional data points from PWC’s research:

- Data Gathering – In most organizations, data gathering takes up over 66% of the Finance teams time and is heavily dependent on spreadsheets.

- Transactional Processing – This type of processing still accounts for ~60% of the effort, while only 26% of time is spent on providing insights.

- Data – Very few organizations have unified enterprise data models, and many organizations often excessive interfaces and reconciliations.

Intelligent Finance teams take a platform approach to CPM, replacing multiple legacy systems, spreadsheets or cloud-based point solutions. The benefit? It simplifies the organization’s IT landscape for administrators and users. This approach reduces the time, effort and costs of maintaining multiple legacy applications while reducing manual data movements and accelerating planning, reporting and analytics.

By eliminating manual work and accelerating these processes, Finance teams can shift their time and attention from administration tasks to performing value-added analysis and decision support – unleashing the true power of Finance.

Step 2: Empowering the Organization with Data-Driven Financial & Operational Insights

With an intelligent platform like OneStream in place, the second step toward becoming an Intelligent Finance team focuses on empowering the organization with financial and operational insights.

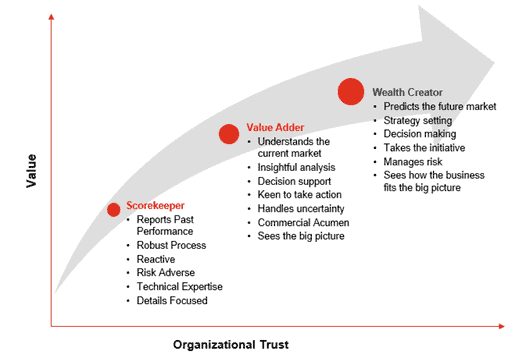

As cost pressures and the pace of change increase, Finance is being asked to do more to help support critical decision-making across the enterprise. But as PWC notes in its “Leading Finance in the 2020’s” research, developing insights and wisdom to inform the business requires Finance teams to elevate from the traditional “scorekeeper” role (see Figure 3) into a wealth creator role for the organization.

Intelligent Finance teams create enterprise value, or wealth – not only by being smart about “the numbers” – but also by first developing organizational trust.

How do they accomplish this? By learning the “big picture” of the business, of course. By working side by side with Sales, Operations, Marketing and HR. By aligning their understanding of the big picture to create data-driven insights around customer or product profitability. And by sharing daily operational analytics and financial signals to drive controllable cost-efficiency.

Intelligent Finance teams leverage data-driven insights to create trust and increase value to the organization. But these teams also rise to the challenge of helping their organizations address altogether new challenges.

Step 3: Evolving the Organization to Address New Challenges & Requirements

Intelligent Finance teams prepare their organizations for the unexpected. Yes, they anticipate what’s next. But how do they do it?

Intelligent Finance teams stretch out beyond the boundaries of the “Finance org chart.” And they put their money where their mouth is by investing in dedicated resources to support Sales, Operations, HR, IT and so on. Why? Well, how else can Finance teams expect to build expertise into the business? How else can Finance teams gain the trust of their business partners? And how else can Finance teams expect to earn their seat at the strategy table to help guide decision-making for extended planning & analysis (see Figure 4).

Intelligent Finance teams also think big when it comes to digital innovation. How? They make technology decisions that move CPM processes forward through automation. They also future-proof the Finance function by making investments with the scale to address a range of capabilities – such as people planning, account reconciliations, machine learning and predictive analytics. And they do it all without adding the technical debt of new, disconnected Finance software.

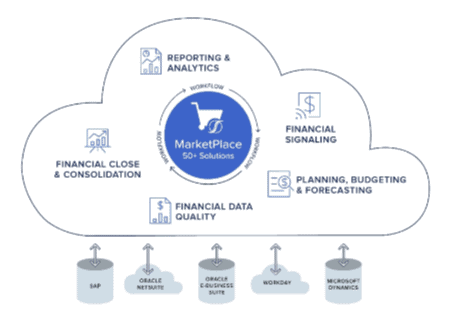

Conquering Complexity to Lead at Speed

OneStream’s Intelligent Finance platform (see Figure 5) was designed with flexibility and scale in mind to help Finance teams conquer complexity to lead at speed. By unifying CPM processes through a single, extensible solution, OneStream eliminates the burden of data gathering, reconciliation and administration of fragmented, connected finance solutions that continue to hold so many Finance teams back from reaching their true potential.

For those of you wondering, “what’s next,” remember this: True Finance Transformation is really more of an evolution than a revolution. And for many Finance teams, no matter where your organization is in the journey, as in life, always know your “why” by operating with a clear purpose and mission for your future.

At OneStream, we call this Intelligent Finance.

Learn More

To learn more about OneStream’s Intelligent Finance Platform, tune in for additional posts from our Inspiring Intelligent Finance blog series and download our interactive whitepaper.

Academic medical centers currently face a variety of financial and operational challenges, in both the short and long term. In the short term, the current COVID-19 pandemic brings abundant challenges, and in the long term, industry evolution remains a constant challenge.

Many of these challenges are shared across the healthcare industry, but academic hospitals face particularly increased complexity and unique situations. Why? Well, they must manage multiple funding sources and complex fund flows between the university, hospital and physician groups – all while also managing wide-ranging activities that include research, teaching, patient care and more.

Transforming the Office of Finance

The recent economic crisis has made one thing clear for academic medical center Finance leaders: they’re facing a new inflection point in the evolution of the Office of Finance. Why is this? Well, as they look to leverage modern technology to evolve their planning and reporting capabilities, the pandemic has emphasized the need for enhanced insight and agility – both of which are essential to react effectively to changing conditions as they occur rather than waiting on the traditional month-end close and reporting cycle. Additionally, these Finance leaders recognize the need to build efficiency in their period-end close process to enable their teams to spend on analysis and decision guidance.

Unfortunately, many medical school Finance teams find themselves hampered while managing their period-end close and reporting cycles with outdated and fragmented point solutions, disparate spreadsheets and siloed data. Many of these teams, constrained by legacy corporate performance management (CPM) solutions, find themselves wasting time managing systems and data. Instead, they should be adding value with insights and immediate operational and financial guidance. And now they can.

Lead at Speed with Financial Signaling & Operational Analytics

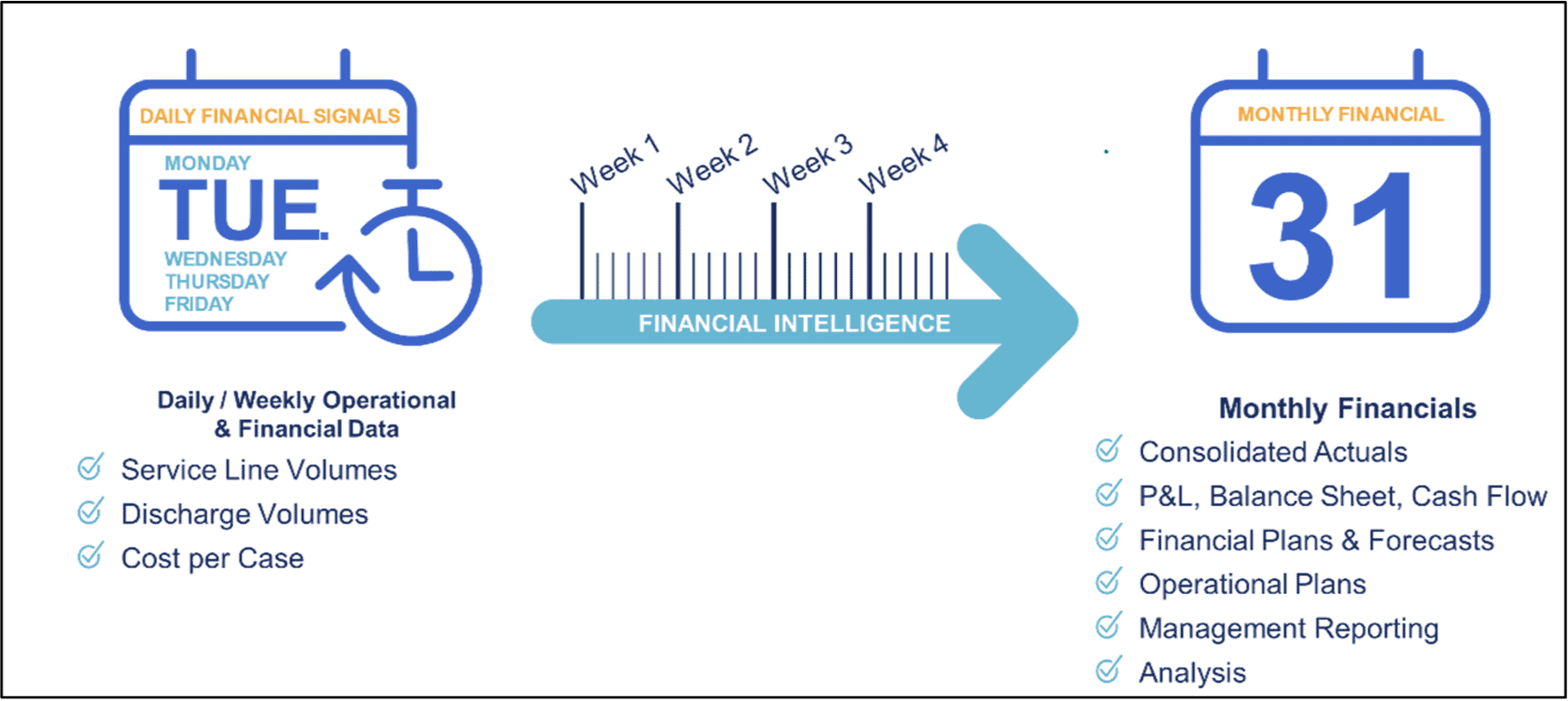

To add value and answer the challenges of today – and tomorrow – academic medical center Finance leaders require a modern solution to break their reliance on the month-end reporting cycle. To decipher the hidden signals within large volumes of daily and weekly operational data. And to gain access to “right time” insights, such as return volume, service-line revenue, admissions, capacity and labor productivity.

In our recent solution brief, “Solutions for Academic Medical Centers,” we discuss how OneStream’s Intelligent Finance platform empowers academic medical Finance leaders to lead at speed with financial signaling (see Figure 1). How? By ensuring these leaders have the agility to react to a rapidly changing economic landscape.

OneStream enables Finance Transformation with a unified platform for financial close & consolidation, budgeting, planning & forecasting, and reporting. By integrating directly with multiple financial and operational data sources, OneStream’s analytic blending intelligently unifies large volumes of transactional data with summarized financial data to create new insights. Financial and Operational leaders gain access to this information through rich, self-service dashboards and interactive reports, allowing leaders to uncover the hidden signals in the daily flow of information.

Figure 1 – Financial Signaling in Action

Unleash Finance Leaders and Key Decision-Makers

OneStream enables Finance teams to maintain trust in the governed financial book-of-record while empowering key decision-makers with the agility required to make changes and impact financials before month-end. Here are just some of OneStream’s key capabilities related to financial signaling and operational analytics:

- Financial Intelligence – Provides pre-built understanding of accounts, currency, ownership, intercompany eliminations and hierarchies to create operationally relevant signals and insights on daily and weekly operational KPIs.

- Analytic Blend – Intelligently combines millions of rows of daily or weekly transactional data from various sources (ERP, CRM, HCM, DW) with governed financial data, analytics, and financial and operational KPIs to enable comprehensive analysis and visualization directly within one application.

- Self-Service Visualizations – Empower Finance teams and Operational leaders with dynamic visualizations and executive dashboards for financial and operational reporting to guide rapid-response decisions.

OneStream also streamlines annual financial report production through automated data loading, reconciliation and reporting. These processes ultimately enable Finance teams to spend less time on the close process and more time on a value-added focus, such as analysis and decision guidance.

OneStream In Action

For a public university that is part of the Southeast’s most comprehensive academic health center and one of the nation’s Top 10 public research universities, OneStream enables visibility into their clinical, accounting, classroom and hospital needs. With OneStream, the university’s 125+ users have confidence and control of their data at the transactional level enabling improved metric tracking for their College of Medicine including number of visits, type of patient, insurance information and more.

Conclusion

OneStream’s Intelligent Finance Platform unleashes academic medical center Finance teams from the constraints of managing legacy applications and disparate tools – by providing insights stemming from the financial signaling and operational analytics capabilities. These Finance teams can then quickly discern timely, actionable insights and lead at speed with continuous performance guidance.

Learn More

To learn more, download our “OneStream Solutions for Academic Medical Centers” solution brief, or contact us for a demonstration.

Empowering Finance teams to unleash their true value and elevate beyond their traditional roles is a basic tenet of OneStream’s mission of delivering 100% customer success. How? At the core, OneStream is designed to empower the organization with the insights required to support effective decision-making, drive performance and lead at speed. In fact, with today’s environment of volatility and market disruption, line-of-business and Finance leaders must have access to accurate, timely and accessible information to survive and thrive amid the unprecedented uncertainty.

Organizational growth typically increases business complexity. More products, more services, more locations, more staff, more customers – and more data to manage and analyze. This complexity often puts a strain on legacy financial systems and processes, delaying the delivery of management information and hindering decision-making. This can become especially acute during times of economic volatility and disruption and becomes the trigger point for change.

“Blue 42, Blue 42, 54 is the Mike, Omaha, set, hut!”. This or a similar cadence can often be heard by a quarterback “calling the signals” during an NFL football game. What’s this all about? To most of us it is unintelligible but to the players on the field it provides essential information. It can be used to set a cadence for the offense or as a tactic to confuse the defense. Each word or phrase called out by the quarterback is scripted to communicate the play to the offense or to communicate the defensive set.

This is just one of the many ways signals are used in football. While remembering the play called in the huddle and listening to the signals the quarterback communicates at the line of scrimmage, the players on the field are also reading specific signals in the defense that will influence how they are going to execute the play.