The post-pandemic global economy continues to provide challenges for CFOs and Finance teams as they navigate rising interest rates, volatile oil prices, continued geopolitical instability and supply chain disruptions. These challenging times require enterprises to have access to near real-time insights and the ability to make agile and informed decision-making. It’s with this backdrop the Forrester Research recently released their landscape report on Digital Operations Planning and Analytics (DOP&A) software solutions. Read on to learn what Forrester defines as the key market requirements and trends and how they view the vendor landscape for this category of software.

Optimizing Performance in a Digital-First World

Forrester defines Digital Operations Planning and Analytics as: “An applications category comprising an integrated set of reporting, analytical, and planning applications that helps organizations develop growth strategies and optimize business performance in a digital-first world.”

According to Forrester, DOP&A tools are critical for running a successful and profitable business because they let you accurately analyze and plan revenue and profits. They also acknowledge that the category is similar to and is also referred to as enterprise performance management (EPM), corporate performance management (CPM), financial planning and analytics (FP&A), and/or eXtended planning & analytics (xP&A). Forrester sees organizations implementing DOP&A solutions to accomplish three main objectives:

- Gain better insights into past business performance.

- Plan for the future with versatile modeling capabilities.

- Ensure accurate reporting and regulatory compliance.

Whereas other IT industry analyst firms often carve up EPM/CPM solutions into separate categories and reports such as Financia Planning vs. Financial Close, Consolidation and Reporting, Forrester recognizes the challenges this fragmented approach has posed for enterprises and promotes the need for holistic DOP&A solutions that can effectively address all requirements.

Key Market Trends

With a long history that stretches back to the 1980’s, Forrester comments on the evolution and maturity that has occurred – creating a new generation of DOP&A solutions, based in the cloud, that can transform how enterprises make business decisions by making sophisticated data analysis more accessible to anyone in finance and beyond. According to Forrester, DOP&A has evolved into an established market that is:

- Hitting its cloud inflection point – with most vendors leading with cloud-based offerings and enterprises migrating from on-premises solutions to modern cloud solutions.

- Broadening beyond its finance-centric roots. While the market interest and solutions were mainly targeted for finance-related activities related to budgeting and planning, DOP&A solutions are expanding into total business operations planning — spanning areas such as workforce, sales, and marketing.

- Leveraging advanced AI. This is not a “nice to have,” solutions in this category are already incorporating AI and machine learning and the race is now on to do this in real time with more advanced data sets and capabilities based on generative AI.

Dynamic Vendor Landscape

With increasing market demand, Forrester highlights how the software vendor landscape for DOP&A solutions has become very dynamic in recent years. This has included investments and acquisitions by private equity firms, acquisitions by ERP vendors, vendor consolidation and many new entrants coming into the market.

Given the wide variety of vendor options available, Forrester recommends buyers pay attention to the following dynamics:

- Planning is becoming more holistic, more enterprise wide, and more frequent in this fast-paced and dynamic world. Although finance touches all money in the business, individual business units need detailed insight into business performance — and all this must connect rather than operate in silos.

- Poor data quality will cripple DOP&A success, as the old adage of “garbage in, garbage out” applies. There’s no silver bullet: Good data hygiene and financial data quality and governance must be in play through the software and implementation services.

- Disruption. This market is seeing a major shake-up, with private equity, large software vendors, and startups vying for success. Forrester sees an active market with many entrants and changes to the established choices.

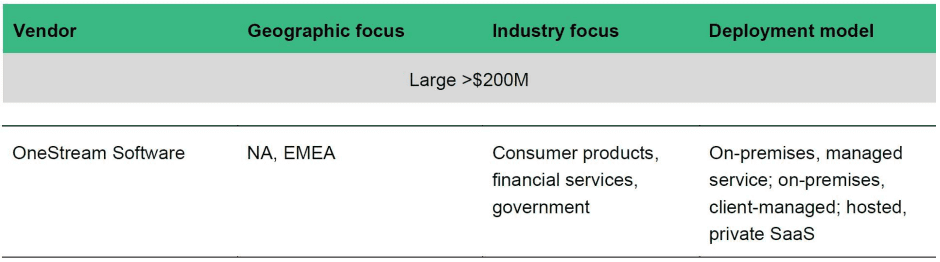

In the report, Forrester lays out the vendor landscape based on DOP&A category revenue generated by company – with large vendors having over $200 million, medium vendors having from $50 million to $200 million, and small vendors having $10 million to $50 million in category revenue. They recommend buyers also take into consideration the geographic and industry focus of various vendors in the market as well as the software deployment model.

Based on our revenue generated in this category, OneStream was listed in the Large >$200M category along with some information about our industry and geographic focus as well as deployment capabilities. (see figure 1 below)

Figure 1 – OneStream Vendor Profile

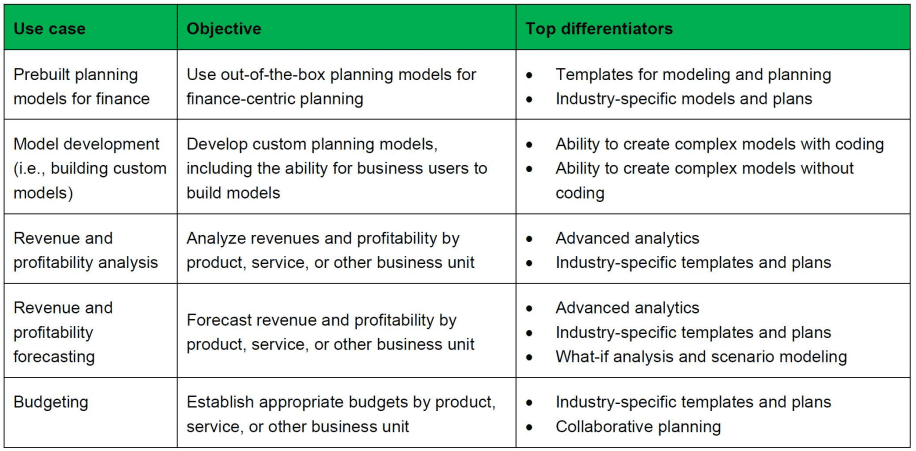

Following this initial grouping of the 25+ vendors covered in the report, Forrester also

highlighted the top use cases for DOP&A supported by the various vendors. This includes

commonly requested use cases such as budgeting, prebuilt planning models for finance, custom

model development, revenue and profitability analysis and forecasting. (See figure 2 below)

Figure 2 – Common Use Cases for DOP&A

Forrester also highlights vendor support for extended use cases, including prebuilt planning models outside finance (e.g., sales, marketing, workforce), financial consolidation, financial reporting, board reporting, and external and regulatory reporting. OneStream’s Intelligent Finance Platform provides strong support for all the core and extended use cases identified by Forrester.

Learn More

We are seeing increased IT industry analyst coverage of CPM/EPM software, and it’s great to see Forrester Research covering this market again, under the DOP&A moniker, after a 5-year hiatus. To learn more, visit Forrester’s web site and contact OneStream if your organization is ready to make the leap from spreadsheets or fragmented legacy CPM applications to a modern, extensible platform designed for the future.

Get Started With a Personal Demo